Business

Flipkart Launches Its Own UPI Handle For Customers; Here’s How Users Can Benefit

In a move aimed at enhancing customer convenience and streamlining digital transactions, Flipkart has unveiled its very own UPI handle. This initiative marks a significant step forward in the e-commerce giant’s commitment to offering seamless and secure payment options to its vast customer base. With this new feature, Flipkart users can now experience unparalleled ease and efficiency when making online purchases.

The introduction of Flipkart’s dedicated UPI handle revolutionizes the way users engage in digital transactions on the platform. Gone are the days of navigating through multiple payment gateways or entering lengthy account details. Instead, customers can now make payments swiftly and securely using their preferred UPI-enabled bank accounts.

One of the key advantages of Flipkart’s UPI handle is its simplicity. By integrating this feature directly into its interface, the platform ensures a hassle-free payment experience for users. Whether browsing for the latest gadgets or shopping for everyday essentials, customers can complete transactions with just a few taps on their smartphones.

Furthermore, Flipkart’s UPI handle enhances security by eliminating the need to share sensitive banking information during transactions. Users can make payments without divulging their account details, thus minimizing the risk of fraudulent activities. This added layer of security instills confidence among customers, fostering trust and loyalty towards the platform.

Another notable benefit of Flipkart’s UPI integration is its compatibility with a wide range of banks and financial institutions. Regardless of the user’s banking partner, they can seamlessly link their accounts to the platform and enjoy uninterrupted shopping experiences. This inclusivity ensures that all customers, irrespective of their banking preferences, can avail themselves of Flipkart’s convenient payment options.

Moreover, Flipkart’s UPI handle empowers users with greater control over their transactions. From tracking payment status to managing refunds and cashbacks, customers have access to comprehensive transaction records within the platform. This transparency not only enhances user experience but also promotes accountability and trust between the platform and its customers.

Additionally, Flipkart’s UPI integration aligns with the Indian government’s vision of a cashless economy. By promoting digital payments and reducing reliance on cash transactions, the platform contributes to the nation’s broader financial inclusion objectives. This initiative not only benefits consumers but also drives economic growth and fosters innovation within the digital payment ecosystem.

In conclusion, Flipkart’s launch of its dedicated UPI handle represents a significant milestone in the evolution of online shopping and digital payments. With its user-friendly interface, enhanced security features, and seamless integration with various banking partners, Flipkart continues to redefine the e-commerce landscape in India. As more users embrace the convenience of digital transactions, Flipkart remains committed to providing innovative solutions that cater to the evolving needs of its customers.

Business

RBI Implements Stringent Measures Against JM Financial Products, Citing Serious Loan Deficiencies

In a decisive move, the Reserve Bank of India (RBI) has imposed strict restrictions on JM Financial Products Ltd, prohibiting the company from engaging in any financing activities related to shares and debentures, effective immediately. The embargo includes the sanction and disbursal of loans against initial public offerings (IPOs), signaling a significant regulatory intervention.

Despite the stringent restrictions, JM Financial Products Ltd is allowed to continue servicing its existing loan accounts using the regular collection and recovery procedures, as clarified by the RBI in an official statement.

The directive issued by the RBI mandates JM Financial Products to cease and desist promptly from all forms of financing against shares and debentures. This encompasses not only the sanction and disbursal of loans against IPOs but also extends to loans against subscriptions to debentures.

The regulatory action comes in response to the RBI’s identification of serious deficiencies in the loans sanctioned by JM Financial Products, particularly concerning IPO financing and subscriptions to non-convertible debentures (NCDs). The central bank conducted a limited review of the company’s books based on information shared by the Securities and Exchange Board of India (SEBI).

The restrictions imposed on JM Financial Products are not permanent. The RBI has outlined that these business limitations will undergo a comprehensive review following the completion of a special audit initiated by the RBI itself. The final decision will be contingent on the satisfactory rectification of the identified deficiencies to meet the standards set by the RBI.

This regulatory intervention reflects the RBI’s commitment to maintaining the integrity and stability of the financial system. By promptly addressing and rectifying the observed deficiencies, JM Financial Products will have the opportunity to regain regulatory trust and resume its normal operations.

The development underscores the critical role of regulatory bodies like the RBI and SEBI in safeguarding the interests of investors and ensuring the health of the financial markets. The RBI’s decision to conduct a special audit indicates a meticulous approach to thoroughly examining the financial practices of JM Financial Products, reinforcing the importance of compliance and transparency in the financial sector.

Market participants and stakeholders will keenly await the outcome of the special audit and subsequent RBI review, as it will influence the future trajectory of JM Financial Products in the financial landscape. The incident serves as a reminder to financial institutions to adhere rigorously to regulatory guidelines and standards to avoid potential disruptions and maintain investor confidence.

In conclusion, the RBI’s imposition of restrictions on JM Financial Products underscores the importance of robust regulatory oversight in the financial sector. The company’s ability to address the identified deficiencies and navigate the regulatory landscape will determine its future standing within the industry. As the situation unfolds, market participants will closely monitor developments to gauge the impact on JM Financial Products and the broader financial ecosystem.

Business

How to Crack UPSC civil services exam Tips and preparation strategies for 2024 exam

Cracking the UPSC Civil Services Examination requires a well-structured and disciplined approach. The exam is known for its vast syllabus and high competition, but with the right strategy and dedication, you can increase your chances of success. Here are some tips and preparation strategies to help you:

1. **Understand the Exam Pattern:**

– Familiarize yourself with the three stages of the exam: Preliminary, Mains, and Interview.

– Understand the exam pattern, marking scheme, and the types of questions asked.

2. **Know the Syllabus:**

– Go through the UPSC syllabus thoroughly for both Prelims and Mains.

– Categorize topics based on your strengths and weaknesses.

3. **Create a Realistic Timetable:**

– Develop a daily, weekly, and monthly timetable that covers all subjects.

– Allocate time based on the weightage of topics and your proficiency in them.

4. **Preliminary Exam Preparation:**

– Focus on NCERT books for building a strong foundation in subjects like History, Geography, Polity, and Economics.

– Practice solving previous years’ question papers and take mock tests regularly.

– Keep abreast of current affairs, and make notes for revision.

5. **Mains Exam Preparation:**

– Develop a deep understanding of Mains subjects, including optional papers.

– Practice answer writing regularly, and focus on presenting your answers in a clear and structured manner.

– Revise your optional subject thoroughly, as it can significantly impact your Mains score.

6. **Current Affairs:**

– Stay updated with national and international news through newspapers, magazines, and online sources.

– Maintain a comprehensive current affairs notebook for quick revision.

7. **Build Analytical and Writing Skills:**

– Enhance your analytical skills by critically analyzing issues and expressing your opinions.

– Practice essay writing, and work on improving your writing speed.

8. **Revision is Key:**

– Regularly revise what you’ve studied to reinforce your memory.

– Create concise notes for each subject to aid in quick revision.

9. **Mock Tests and Previous Year Papers:**

– Take regular mock tests for Prelims and Mains to assess your preparation.

– Analyze your mistakes and weaknesses to focus on improvement.

10. **Health and Well-being:**

– Ensure a balanced lifestyle with adequate sleep, exercise, and relaxation.

– Maintain a positive mindset, and manage stress through meditation or other relaxation techniques.

11. **Stay Consistent:**

– UPSC preparation is a marathon, not a sprint. Stay consistent with your efforts throughout the entire preparation period.

– Learn from your mistakes and continuously adapt your strategy based on your progress.

12. **Interview Preparation:**

– Stay updated on current affairs and have a clear understanding of your DAF (Detailed Application Form).

– Practice mock interviews to improve your communication skills and build confidence.

Remember, the UPSC Civil Services Exam demands dedication, perseverance, and a comprehensive understanding of the subjects. Develop a customized strategy based on your strengths and weaknesses, and consistently work towards your goal. Good luck!

Business

Global Call to Action: Uniting to Save Our Environment from the Menace of Global Warming and Pollution

As the world grapples with the escalating threats of global warming and pollution, a resounding call for collective action reverberates globally. The urgent need to preserve our environment and protect the atmosphere from irreparable damage has never been more critical.

**Rising Concerns:**

The specter of global warming looms large, accompanied by an alarming surge in pollution levels. Greenhouse gas emissions, deforestation, and unchecked industrial activities contribute to the degradation of our environment, leading to severe consequences such as rising sea levels, extreme weather events, and loss of biodiversity.

**Environmental Activism Gains Momentum:**

From grassroots movements to global initiatives, environmental activists and organizations are amplifying their efforts to combat the growing threats. The Fridays for Future movement, inspired by Greta Thunberg, and initiatives like Earth Hour and World Environment Day are mobilizing individuals, communities, and nations to take meaningful steps towards a sustainable future.

**Renewable Energy Revolution:**

The transition to renewable energy sources stands as a beacon of hope in the battle against global warming. Nations worldwide are investing in solar, wind, and hydroelectric power to reduce their reliance on fossil fuels. The embrace of electric vehicles, coupled with advancements in green technologies, is reshaping the energy landscape and paving the way for a cleaner, more sustainable future.

**Government Policies and International Cooperation:**

Governments are increasingly recognizing the gravity of the situation and implementing policies to curb pollution and mitigate the impacts of climate change. International agreements such as the Paris Agreement underscore the importance of global cooperation in tackling these challenges. The commitment of nations to reduce carbon emissions is a crucial step toward safeguarding our environment for future generations.

**Individual Responsibility:**

While governments and organizations play a pivotal role, individual actions collectively have a substantial impact. Adopting eco-friendly practices, reducing single-use plastics, conserving energy, and supporting sustainable products are ways individuals can contribute to the larger goal of environmental preservation.

**The Role of Corporate Responsibility:**

Businesses are also recognizing the importance of corporate social responsibility in the face of environmental challenges. Many are adopting sustainable practices, reducing their carbon footprint, and integrating environmental considerations into their business models.

**Educating the Next Generation:**

Equipping the next generation with knowledge about environmental conservation is key to securing a sustainable future. Educational institutions and communities must prioritize environmental education, fostering a sense of responsibility and environmental stewardship among young minds.

**Conclusion:**

The urgency to save our environment from the perils of global warming and pollution demands a united front. As individuals, communities, businesses, and governments come together to address these challenges, there is hope that our collective efforts will pave the way for a greener, cleaner planet. The time for action is now, and each positive step taken today contributes to a healthier, more sustainable world for generations to come. Let this be a global call to action – a resolute commitment to save our environment and atmosphere from the looming threats of climate change and pollution.

-

Sports2 months ago

Sports2 months agoUnraveling the Challenge: IND vs ENG in Dharamsala – Rohit Sharma and Ben Stokes Contemplate Pitch Dynamics and Conditions

-

Fashion2 months ago

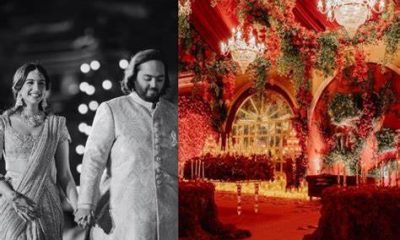

Fashion2 months agoFashionable Highlights from Anant Ambani and Radhika Merchant’s Pre-Wedding Finale

-

Featured2 months ago

Featured2 months agoDharamsala weather update, IND vs ENG: Will rain play spoilsport in India vs England 5th Test? Dharamsala weather update, IND vs ENG: Dipping temperatures, rain and sleet could play spoilsport at the HPCA Stadium during the fifth Test between India and England from Thursday.

-

Fashion2 months ago

Fashion2 months agoMonica Lewinsky Transforms Career Path, Embraces Modeling for Sustainable Fashion

-

Entertainment2 months ago

Entertainment2 months agoShah Rukh Khan greets guests with Jai Shree Ram ‘for good measure’ at Ambani pre-wedding bash, turns host.

-

Featured2 months ago

Featured2 months agoByju’s CEO Raveendran says unable to pay salaries, lambasts investors for blocking funds

-

Sports2 months ago

Sports2 months ago‘World’s shortest retirement’: Pat Cummins responds to prospect of Neil Wagner returning for 2nd NZ vs AUS Test

-

Featured3 weeks ago

Featured3 weeks agoMPB College: Nurturing Tomorrow’s Healthcare Leaders Through Excellence in Education and Patient-Centered Care